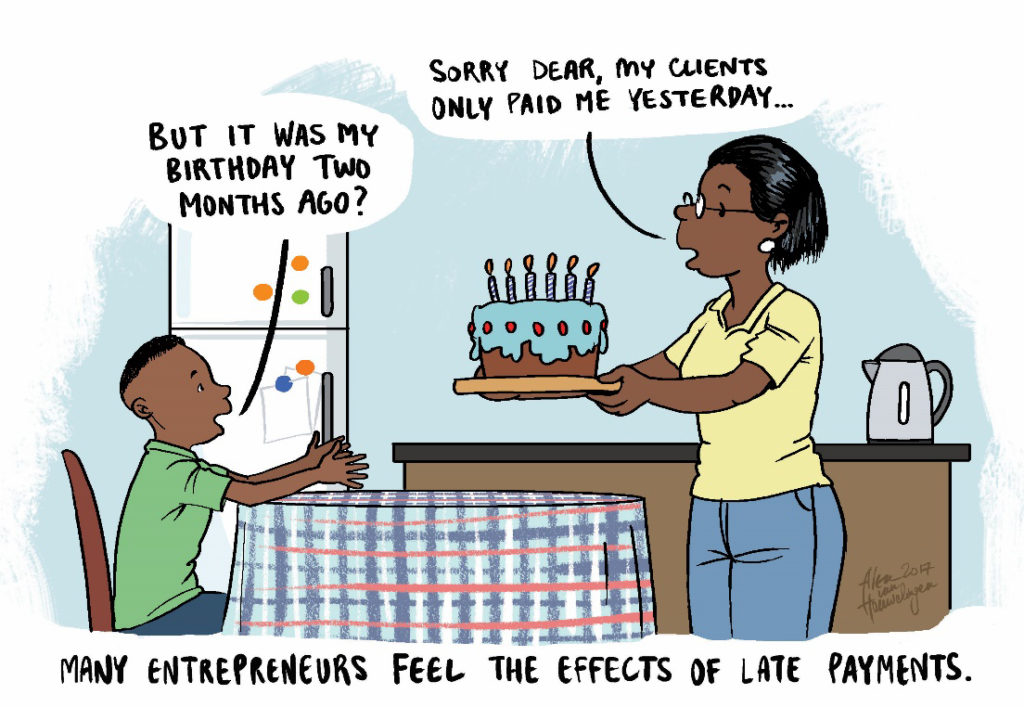

Late payments: The knock-on effects on SA small businesses

52% of South African small businesses experience direct negative impacts from late payments

Johannesburg, SOUTH AFRICA, 8 December 2017 – An economic report published by Sage, the global market leader for technology, reveals the detrimental impacts of late payments on Small & Medium Businesses, currently equating to R25 billion ($3 trillion) globally. With 15% of invoices in South Africa paid late, the study reports that more than 8% of payments due to the country’s Small & Medium Businesses are never made or made so late that businesses are forced to write them off as bad debt.

‘Late Payments: The Domino Effect’ highlights that 52% of South African Small & Medium Businesses experience direct negative impacts from late payments. As a consequence of late payments:

– 28% say they struggle to pay bonuses around the festive period,

– 34% say they pay suppliers late, and

– 28% say they delay investments into their businesses.

When looking at the reasons why Small & Medium Businesses don’t follow up on payments, 40% of those surveyed in South Africa say it is to protect client relationships, indicating that there is a stigma around this. Some 24% say they have no dedicated resource for the job and 13% say they don’t have time to do it.

Charles Pittaway, Managing Director at Sage Pay, said: “Late payments have a worrying impact on the profitability and sustainability of South Africa’s Small & Medium Businesses, many of which have low cash reserves and tight cash flow. Knock-on effects of late payments include small business struggling to pay their suppliers on time, taking advantage of early settlement discounts, and having less cashflow for investment in growing the business.

“Large enterprises and government should make paying small suppliers and service providers on time a priority to help foster a job-creating small business sector. Finance Minister Malusi Gigaba highlighted the importance of government paying invoices to small suppliers within 30 days in his Medium-Term Budget Policy Statement this year – a development which we welcome and support.

“With the challenges faced by small businesses, they deserve what is owed to them for their hard work and perseverance. We believe that yesterday’s invoice doesn’t have to be tomorrow’s problem.”

“For a small business, cash flow is key. If we – as a new entrant – are tardily paying suppliers because our customers pay us late, we cannot benefit from bigger trade discounts. That, in turn puts pressure on our margins, pricing and competitiveness,” saysJeff Cullis, Founder of Urban Organics, the 2017 Cape Talk Small Business Awards with Sage winner. “Plus, calling debtors to collect outstanding payments is a waste of time and money. To avoid these problems, we insist on prepayment from our customers, but this means we are unable to do businesses with many larger buyers who only operate on an account.”

For South African small businesses, between 5% and 10% of their administrative work is related to following up on late payments. Survey respondents also indicate that they spend an average of 20-man days a year doing this and incurred more than R48,000 in costs chasing overdue debtors.

Undertaken by Plum Consulting, the research analysed responses from over 3,000 business builders to look at the effects of late payments on Small & Medium Businesses. It highlights significant implications for our entrepreneurs and their ability to operate, plan and grow.

Global snapshot: Late Payments Landscape – The Domino Effect

Across the 11 countries analysed Small & Medium Businesses account for at least 96% of total enterprise, ‘protecting client relationships’ is the most cited reason for not chasing late payments – leading Sage to call for a fundamental shift in culture for Small & Medium Business to be proud to chase for work undertaken.

| Country | Proportion of invoices that are paid late (%) | Average number of days per year spent by SMEs chasing up late payments | Top barrier to chase late payments for SMEs in each country | Proportion of invoices that become bad debt (%) |

| UK | 18 | 15 | Protect client relationship (40%) | 9 |

| South Africa | 15 | 20 | Protect client relationship (40%) | 9 |

| France | 11 | 6 | Protect client relationship (21%) | 8 |

| Ireland | 15 | 7 | Protect client relationship (43%) | 8 |

| Australia | 9 | 5 | Protect client relationship (29%) | 7 |

| Brazil | 7 | 14 | Protect client relationship (35%) | 7 |

| Canada | 10 | 7 | Protect client relationship (31%) | 8 |

| Singapore | 18 | 15 | Protect client relationship (41%) | 9 |

| Spain | 12 | 18 | Protect client relationship (37%) | 8 |

| United States | 13 | 15 | Protect client relationship (32%) | 10 |

| Germany | 9 | 5 | Protect client relationship (31%) | 8 |

Tim Miller, Partner at Plum Consulting, said, “Losing the cultural stigma of chasing late payments is crucial to escaping the domino effect – all the time that SMEs are worrying about chasing late payments, their own suppliers will be paid late, and the cycle will continue. SMEs are more likely to trade with other SMEs, meaning this will disproportionally affect smaller companies. An automatic system to send reminders for unpaid bills may get over the cultural aversion – and could also overcome the lack of staff and resources that some SMEs cite as reasons for not chasing late payments.”