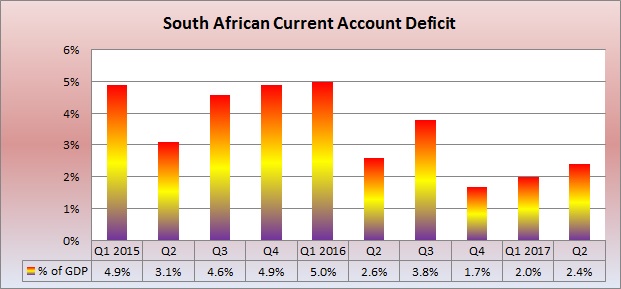

The South African current account deficit on the balance of payments widened to 2.4% of gross domestic product (GDP) on a seasonally adjusted annualised basis in the second quarter 2017 from a revised 2.0% (2.1%) in the fourth quarter 2016, the South African Reserve Bank (SARB) said in its latest Quarterly Bulletin.

Economists had expected a narrowing in the current account deficit to 1.9% of GDP in the second quarter due to the large foreign trade surplus, but the improvement in the trade surplus was outweighed by the widening in the services, income and current transfer deficits. The trade surplus improved to 1.4% of GDP in the second quarter from 1.3% in the first quarter, but the deficit on the other accounts widened to 3.8% of GDP from 3.3% of GDP.

The SARB said that although the net inflow of capital on South Africa’s financial account of the balance of payments declined from the first to the second quarter of 2017, the shortfall on the current account was mainly financed through net portfolio investment inflows. Non-resident investors continued to acquire South African debt securities in particular, driven largely by the ongoing global search for yield.

The financial account surplus narrowed to only 0.3% of GDP in the second quarter from 3.4% in the first quarter. This is in part due to the downgrade in South Africa’s credit rating to sub-investment or junk status from investment grade by two major credit rating agencies in April.

Export growth has outpaced import growth helped in part due to improved terms of trade in 2017 relative to 2016. These foreign trade dynamics are expected to persist in the coming quarters as countries such as China, India, Japan and Taiwan import coal, iron ore and maize in ever greater quantities with bulk export volumes up 6.8% y/y in the first eight months of the year. On the domestic front, import growth is expected to remain subdued due to poor consumer and business confidence.